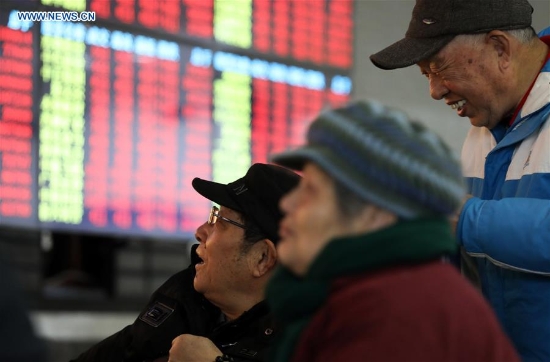

Investors are seen at a stock trading hall in east China's Shanghai, Feb. 25, 2019. Major stock indices in China surged more than 5 percent Monday, with the benchmark Shanghai Composite Index up 5.6 percent to 2,961.28 points. The Shenzhen Component Index closed 5.59 percent higher at 9,134.58 points. (Xinhua/Zhuang Yi)

BEIJING, Feb. 25 (Xinhua) -- Major stock indices in China surged more than 5 percent Monday led by the financial sector.

The benchmark Shanghai Composite Index started the day with a 1.22-percent gain and maintained the upward trend throughout the day to surge 5.6 percent to close at 2,961.28, the highest closing since mid-June 2018.

Trading volume of stocks in the index soared from Friday's 264.5 billion yuan (39.4 billion U.S. dollars) to 466 billion yuan, the highest turnover in more than three years.

The benchmark index has rebounded 18.74 percent since the beginning of the year and surged more than 21 percent from this year's lowest point of 2,440.91 points seen in early January, which marked the entry into "a technical bullish cycle" by some analysts.

The Shenzhen Component Index closed 5.59 percent higher at 9,134.58 points, the highest closing since the end of July 2018, and the turnover of stocks in the index reached an all-time high of 574.6 billion yuan.

China should deepen supply-side structural reform in the financial sector and strengthen the sector's ability to serve the real economy, and economy and finance are interdependent and should grow and thrive together, according to a study session of the Political Bureau of the Communist Party of China Central Committee on Friday.

On Monday, the financial sector was the strongest among all sectors, with the sub-index surging 9.11 percent and all securities brokerage firms surging by the daily limit of 10 percent.

The sector's strength came as the China Banking Association (CBA) and the Securities Association of China both planned to lower the costs of their member institutions, with the CBA expecting to reduce membership fees by 14.5 million yuan in 2019.

Although both plans are designed for the members of the two associations, they have lifted market expectations for industry-wide stimulus in the future.

The ChiNext Index, China's NASDAQ-style board of growth enterprises, gained 5.5 percent to close at 1,536.37 points.